Table of Contents

- Summary

- Market Categories and Deployment Types

- Key Criteria Comparison

- GigaOm Radar

- Vendor Insights

- Analyst’s Take

- Methodology

- About Andrew Green

- About GigaOm

- Copyright

1. Summary

Global Low-Power Wide Area Network (LPWAN) providers offer Internet of Things (IoT) connectivity as a service over widespread geographical areas. In this report, we’ll be assessing vendors who operate in the unlicensed spectrum, which is a set of frequency bands in the Industrial, Scientific, and Medical (ISM) range, and do not require the vendors to apply for or purchase at auction licenses from national telecommunications regulators.

This ability to operate without a license lowers a significant entry barrier and enables startups to disrupt the wider IoT technology space with innovative approaches. Within the unlicensed LPWAN network providers space, we’ve identified four types of IoT connectivity providers:

- Network operators: This model resembles the one used by mobile network operators (3G/4G/5G), in which the operator deploys and manages the core infrastructure and the radio access networks (RANs). The operator is solely responsible for deploying new gateways to provide coverage in other areas. Typically, network operators offer IoT connectivity in a network-as-a-service model, for which the customer only needs to subscribe their devices to the network. In this report, we classify as network operators the following vendors: Everynet, Netmore, Sigfox, and Senet.

- Satellite-based connectivity: An increasing number of vendors are entering the market offering ubiquitous connectivity via satellites. Devices can communicate with satellites either directly or indirectly through lightweight and portable gateways. To connect to a satellite network, network providers can use protocols such as LoRa on Very High Frequency (VHF) to either connect directly to devices, or to transceiver gateways. The only satellite-based vendor featured in this report is Swarm Technologies. However, other vendors such as Lacuna Space and Echostar Mobile will launch commercial offerings in the near future.

- Open, community-based network: A central provider operates the core infrastructure, namely the network servers, while the gateways (which provide the coverage) are run by third parties, which can be either enterprises or consumers. The advantages of building IoT solutions on community-based networks are low costs (even free) and high flexibility. The Things Network is the only community-based network featured in this report.

- Decentralized, blockchain-based network: Central providers deploy and maintain the core infrastructure, while gateways are operated by independent third parties. Gateway operators are incentivized to run gateways by using them to mine cryptocurrencies and are rewarded based on the gateway’s health and proof of connectivity. Operating on a blockchain network creates tamper-resistant records of shared transactions, which allows enterprises to share and access IoT data without a central authority. We feature the following vendors in this category: Helium, MXC Foundation, and Nesten.

Throughout these four categories of LPWAN network providers, enterprises have many options available for their use cases. Each type of provider has advantages and disadvantages. For example, network operators follow a tried-and-tested model that can offer better carrier-grade SLAs. Satellite providers can provide connectivity in areas where other communications are not available, and decentralized networks have the highest scalability potential and can have lower subscription costs.

How to Read this Report

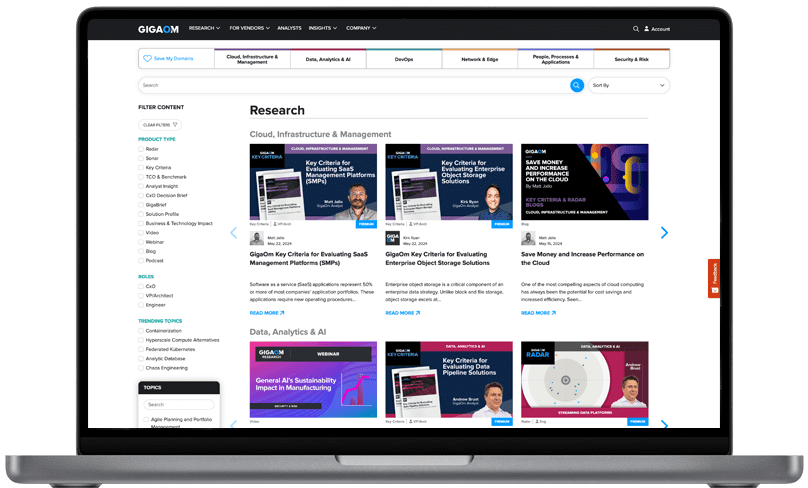

This GigaOm report is one of a series of documents that helps IT organizations assess competing solutions in the context of well-defined features and criteria. For a fuller understanding consider reviewing the following reports:

Key Criteria report: A detailed market sector analysis that assesses the impact that key product features and criteria have on top-line solution characteristics—such as scalability, performance, and TCO—that drive purchase decisions.

GigaOm Radar report: A forward-looking analysis that plots the relative value and progression of vendor solutions along multiple axes based on strategy and execution. The Radar report includes a breakdown of each vendor’s offering in the sector.

Solution Profile: An in-depth vendor analysis that builds on the framework developed in the Key Criteria and Radar reports to assess a company’s engagement within a technology sector. This analysis includes forward-looking guidance around both strategy and product.