Table of Contents

- Summary

- Market Categories, Deployment Types, and Target Audience

- Key Criteria Comparison

- GigaOm Radar

- Vendor Insights

- Analyst’s Take

- Methodology

- About Jon Collins

- About GigaOm

- Copyright

1. Summary

As we write this report, we are confronted with the new reality of the existential role of IT operations faced by many organizations today. Enterprises large and small are looking to transform, to become the kinds of businesses and public service providers they know they can be if only they can deliver faster, be more agile, and embrace and harness the power of digital technologies. Organizations envy the poster children of the latest waves of innovation—the Amazons and Spotifys, the Teslas, and AirBnBs—and have sought to adopt similar approaches.

And yet, we need to recognize that this goal is fundamentally unachievable—or at least no more achievable than having a hit record. For every digital success story, dozens of failures go quietly undiscussed. The reality is that delivering technology-based innovation is hard for multiple reasons, which might all boil down into one word: complexity. Technology is constantly evolving, and so are the ways in which it can be used. At the same time, once technology is deployed, it immediately creates inertia because it needs to be operated and managed. Technical debt—the cost of maintenance that takes money away from innovation—is a challenge for all organizations.

What’s all this got to do with value stream management (VSM)? As we wrote in the companion Key Criteria report, VSM exists to ensure the value of technology delivery as defined by benefits minus costs. Costs can certainly be better understood and managed with VSM tools and practices by removing bottlenecks and enabling efficiency improvements; however, delivering faster and cheaper means nothing if the resulting outputs are not of value to the business. In this Radar report, we look at how solution providers enable this value to be visualized, mapped to business goals, and then optimized, which is highly useful in itself.

While reviewing vendors, we have seen different yet equally valid approaches have emerged to drive greater value. In their most straightforward incarnation, VSM tools combine a data integration platform—which pulls together information from continuous integration/continuous delivery (CI/CD) and other development tooling—and information dashboards, enabling users to see what is going on. For organizations looking to build a coherent picture and move away from spreadsheets and customized business intelligence (BI) tools, there’s a lot to like about VSM.

What happens next largely depends on who the audience is, which also underpins the rationale founders embraced when first specifying their solutions. Some target development teams directly, while others take aim at a level (or two) above, focusing on product owners; some go higher still, helping VPs of engineering and CTOs; and a handful aim directly at the board of directors level. The other significant variable is what the tooling aims to achieve over time. Some providers have adopted a do-it-right-the-first-time approach (as espoused by many quality management approaches), strongly prescribing a top-down methodology; whereas others are more about helping their customers evolve on their own journey towards standardization.

We focus on these target areas as we review VSM vendors, and in the wrap-up, we advise against tactical adoption of VSM, even if shorter-term gains are relied upon to bring its concepts over the threshold. If solving for complexity is the goal, organizations cannot afford to bring in yet another management platform in isolation from their greater goals. Instead, these tools are best considered as mechanisms to support and drive strategy, as enablers to enterprises on their digital transformation journeys.

How to Read this Report

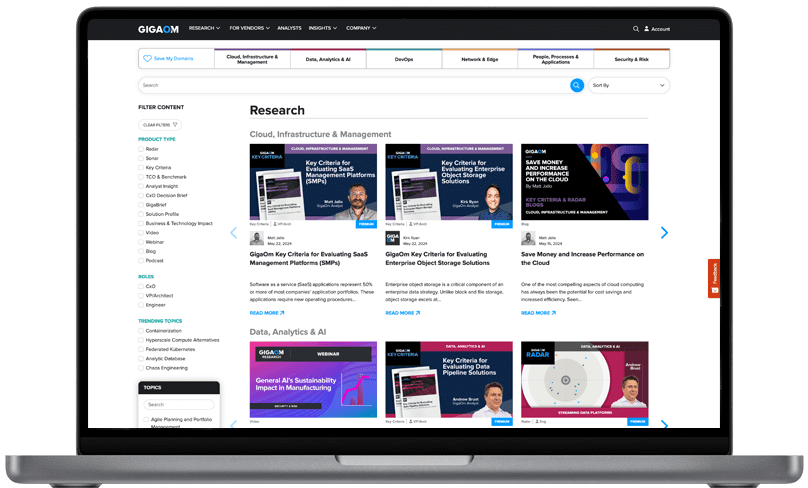

This GigaOm report is one of a series of documents that helps IT organizations assess competing solutions in the context of well-defined features and criteria. For a fuller understanding, consider reviewing the following reports:

Key Criteria report: A detailed market sector analysis that assesses the impact that key product features and criteria have on top-line solution characteristics—such as scalability, performance, and TCO—that drive purchase decisions.

GigaOm Radar report: A forward-looking analysis that plots the relative value and progression of vendor solutions along multiple axes based on strategy and execution. The Radar report includes a breakdown of each vendor’s offering in the sector.

Solution Profile: An in-depth vendor analysis that builds on the framework developed in the Key Criteria and Radar reports to assess a company’s engagement within a technology sector. This analysis includes forward-looking guidance around both strategy and product.