Table of Contents

- Summary

- Market Categories and Deployment Types

- Key Criteria Comparison

- GigaOm Radar

- Vendor Insights

- Analysts’ Take

- Methodology

- About Ron Williams

- About Lisa Erickson-Harris

- About GigaOm

- Copyright

1. Summary

Information technology service management (ITSM) provides a structured means for IT operations to define and deliver services to an organization, its partners, collaborators, and others requiring service value from IT. In its current evolution, ITSM is geared to deliver business value to the organization. As a result, services and their respective catalogs often look like a business service being run by IT. The components of a service encompass infrastructure, assets, people, uptime, configuration, and cost. Workflow management is a core component for handling incidents, service requests, problems, and changes—as well as automation—to drive efficiencies within the organization. Collectively, these factors demonstrate IT’s business value and its contributions to the success of the organization.

The domain of ITSM has grown substantially over a number of decades. With that growth, vendor solutions designed for the enterprise, medium-sized businesses, and service providers are commonly developed in accordance with a best-practices framework, usually the Information Technology Infrastructure Library (ITIL), which defines specific processes for handling IT services. ITIL is now in its fourth generation, which represents significant change. The goals of each version are as follows:

- ITIL was originally developed to guide the provisioning of IT services by the Central Computing and Telecommunications Agency (CCTA), a government agency in Britain.

- ITIL 2 added definitions related to service support and delivery.

- ITIL 3 established a five-part service management lifecycle: service strategy, service design, service transition, service operation, and continuous improvement.

- ITIL 4 shifted focus to demonstrate business value and digital transition of all service management functions.

The transition from ITIL 3 to ITIL 4 is underway, with some vendors offering both. Buyers committed to best practices are either currently in the midst of adopting ITIL 4 or still evaluating the impact of migrating to the new version. Some market estimates suggest that 20% of ITIL shops have already transitioned to ITIL 4 while another 30% are considering making such a move. For non-ITIL shops that are just starting, best-practice adoptions can begin with ITIL 4. Note, however, that ITIL 3 shops will still benefit from creating ITIL 3 workflows and leveraging prior efforts as ITIL 4 does not eliminate the need for most of those functions.

Importantly, for this report, we’re evaluating ITSM vendors that support the transition from ITIL 3 to ITIL 4 and already offer ITIL 4 certifications, while also assessing the level of ITIL 3 and ITIL 4 framework support in three different categories: ITSM essentials, ITSM infrastructure insight, and ITSM business value. Our scoring examines vendor offerings in these three areas and in other important key criteria and evaluation metrics. The report covers vendors from North America, South America, Europe, and Asia.

This GigaOm Radar report highlights key ITSM vendors and equips IT decision-makers with the information needed to select the best fit for their business and use case requirements. In the corresponding GigaOm report “Key Criteria for Evaluating ITSM Solutions,” we describe in more detail the capabilities and metrics that are used to evaluate vendors in this market.

How to Read this Report

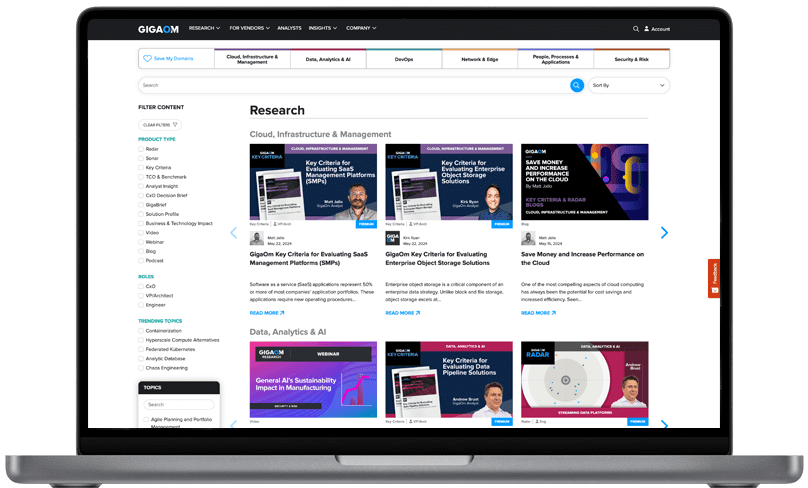

This GigaOm report is one of a series of documents that helps IT organizations assess competing solutions in the context of well-defined features and criteria. For a fuller understanding, consider reviewing the following reports:

Key Criteria report: A detailed market sector analysis that assesses the impact that key product features and criteria have on top-line solution characteristics—such as scalability, performance, and TCO—that drive purchase decisions.

GigaOm Radar report: A forward-looking analysis that plots the relative value and progression of vendor solutions along multiple axes based on strategy and execution. The Radar report includes a breakdown of each vendor’s offering in the sector.