Table of Contents

- Summary

- Who is most likely to develop a smart watch?

- How likely is it that each of the following companies will release a smart watch?

- How useful would the following capabilities be in a smart watch?

- Would you consider buying a smart watch?

- Do you see the smart watch as a replacement for the cell phone?

- What is the most you would pay for a smart watch?

- Will Pebble survive the entrance of Apple, Samsung, or another tech company?

- Addendum: some select open-ended responses

- About Michael Wolf

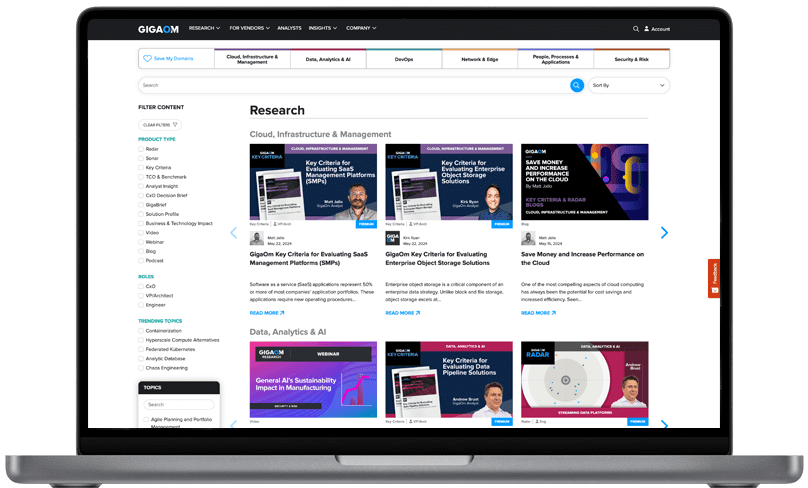

- About GigaOm

- Copyright

1. Summary

Ever since the 1940s, when Dick Tracy first brandished a wrist watch that doubled as a communication device, nerds have dreamed of the day when they could actually have their own spy — or rather “smart” — watch.

And for the past few decades, there has been no shortage of people trying to pack smarts into watches. From basic calculator watches to Seiko’s RC series and more recently IBM’s attempt to create a Linux watch, the dream has stayed alive, even if it has been more wishful thinking than commercial success.

But all of that may be set to change soon. With the continued miniaturization of technology, the rise of flexible software frameworks, and the growing interest in technologies such as biomonitoring and location-based services, the smart watch is fast becoming technology’s next big thing.

One of the reasons for this interest is the continued maturation of other mobile platforms. While smartphones remain new profit drivers, companies like Apple, Samsung, LG, and Google see smart watches as a potential new growth category.

At the same time, the category has been somewhat validated by the highly successful early reception of the Pebble Watch, which came to fruition after becoming the most successful gadget launch on Kickstarter.

Because of all of this, we decided to survey our own smart readers about the smart watch market to get a sense of the category and an early indication for potential competitors, price points, features, and, of course, demand.

So what did we find out? In brief:

- The early rumor mill and brand awareness seem to have influenced our respondents’ thinking. Of all the potential smart watch makers we named — Apple, Samsung, Google, Microsoft, and LG — the only two that have actually made anything resembling a smart watch registered lowest on the respondents’ radars. On the other hand, Apple and Samsung are seen as the most likely to release a smartphone. Google — which has filed for patents for smart watch designs — was in the middle of the pack in terms of respondents’ expectations for a product.

- Quantified self — and biometric-sensing apps — topped the want list. We asked our respondents what functionality they would want, and the runaway winner was biometric sensors. That’s not surprising if you consider that much of the recent momentum for wearables has been driven by companies like Fitbit and even Pebble, which makes a crowdfunded smart watch that has a health and fitness sensing tilt.

- About one-third of our respondents were likely early adopters, others tended to wait and see. We asked if our respondents would buy a smart watch, and roughly one in three had it on their short list. Fifty percent had the product filed under “unlikely,” though we believe that’s normal for new product categories that consumers don’t quite understand or see a need for yet.

- Price points are currently expected to be low, which should result in some interesting decisions by vendors. Currently our respondents see palatable prices at below $200, which might present a challenge for vendors like Apple and Samsung, which tend to come out with premium pricing for newer products. What makes this a potentially interesting challenge is the fact that there might not be any carrier subsidization (though that could obviously change).