Table of Contents

- Summary

- An evolving retail market

- The smart-home consumer

- Smart-home retail approaches

- Key takeaways

- About Michael Wolf

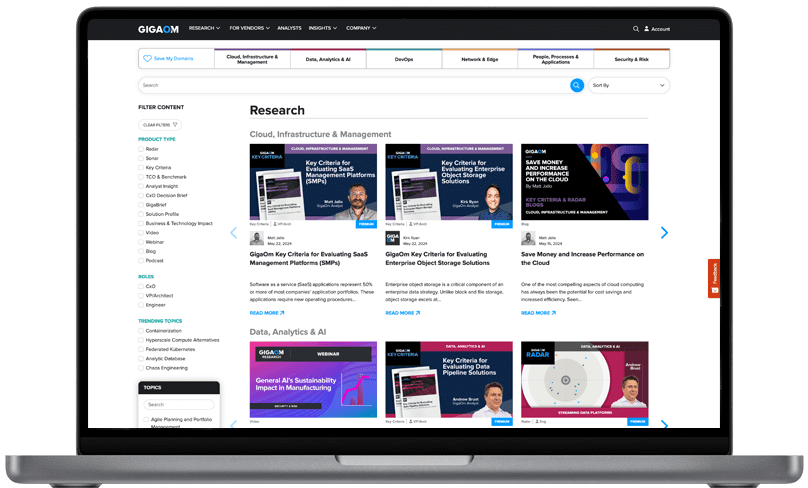

- About GigaOm

- Copyright

1. Summary

Today’s smart-home marketplace is one still largely being defined. Unlike more mature technology markets, the smart home has a variety of technologies still vying to become the de facto standard, from various radios (Bluetooth LE, Wi-Fi, Z-Wave, Zigbee, Thread) to a set of different software standards and frameworks (HomeKit, Works with Nest, AllJoyn).

With the technology itself still unsettled, how consumers will buy into the smart home on a large scale remains a question. There are many companies offering a variety of approaches, from entire hub-centric platforms complete with cloud accessibility and apps to focused-point devices such as smart locks and smart lighting. These latter approaches resonate with consumers in part because they are far easier to comprehend.

Perhaps most uncertain — and fast evolving — is the retail landscape for the smart home. Most of the big retailers who offer smart-home technologies, and even those that are somewhat tangential to tech as a product category (Lowe’s, Home Depot), stake a claim to the smart home by creating focused product sections within stores, ranging from basic end caps to full-fledged areas with dedicated staff who can walk consumers through products and answer questions. But despite all of this effort, the complexity of the smart-home concept and consumers’ uncertainty over the value proposition is proof that retailers have a long way to go before the puzzle of smart home retail is solved.

It’s an important battle that represents potentially tens of billions of dollars. This report will examine the smart-home retail environment and how it matches up against current consumer sentiment.

Key findings include:

- Currently consumers don’t see a compelling need for smart-home technology, which means that retailers must provide significant market education.

- Because of consumer uncertainty and the lack of a clear leader in this space, most large national technology and home improvement retailers are moving fast to establish a foothold in the market.

- The approaches taken by the big retailers are widely varied, but each represents a significant investment that often taps into a given company’s core strengths.

Thumbnail images courtesy of iStock/Getty Images.