Table of Contents

- Summary

- Collaborative Whiteboard Primer

- Report Methodology

- Decision Criteria Analysis

- Evaluation Metrics

- Analyst’s Take

- Methodology

- About GigaOm

- Copyright

1. Summary

Everyone is familiar with the marker-on-melamine whiteboard that has been the focal point of countless corporate brain-storming sessions and product planning meetings. Now vendors are working to digitize and democratize this uniquely collaborative medium, enabling teams both remote and present to collaborate, share, and participate in a rich, digitally-enabled environment.

The departure these next-generation “digital whiteboards” represent from their analog starting point is so profound that I’m tempted to coin a name for this emergent category—workboards. And while we will use this term and collaborative whiteboards throughout this report, it’s worth noting that many of the vendors in this space describe their digital whiteboards as “digital workspaces for visual collaboration” or “virtual work platforms,” among other variations.

Key Findings

The demand for digital whiteboard platforms has been accelerated by the increased level of distributed work (or remote work) caused by the coronavirus, denying people the ability to pull a team into a conference room to brainstorm, lay out a product plan, or to undertake a project retrospective.

The initial use case for these tools was to implement a whiteboarding experience with a digital emulation, and particularly the collaborative experience of synchronous co-authoring among team members with the digital equivalents of sticky notes, pens, and erasers. Since then, asynchronous creation, management, and information sharing on virtual canvases have emerged as a primary use case. The result: These digital whiteboards (or workboards) increasingly must serve use cases that span work-from-home, work-in-office, synchronous, and asynchronous scenarios.

Workboards are an additional class of collaboration software with some degree of overlap with more well-known kinds of collaboration tools, like work chat (such as Slack and Microsoft Teams), video conferencing (like Zoom and Google Meet), file-sharing platforms (like Box, Dropbox, OneDrive, and Google Drive), and many other kinds of software. As a result, integration with other software platforms is a major aspect of the workboard value proposition and one of the key emerging trends in the marketplace.

Several of the products reviewed in this research started as collaborative whiteboards for large-format, touch-sensitive displays intended for real-time cooperative use within conference rooms. These include Microsoft Whiteboard developed for the Microsoft Surface Hub display, and Google Jam developed for the Google Jamboard. Because of the rapid migration to distributed work, companies are generally using web-browser versions of collaborative whiteboards, influencing these companies’ product directions.

One emerging trend is smart, model-based templates for workboards, such as a canvas that encodes a step-by-step process for a team to capture a business model’s various elements. Or a project retrospective template that encourages—or requires—information to be added and evaluated according to company policies. Many vendors have developed dozens and, in some cases, hundreds of these templates. These go far beyond just snapping sticky notes to a grid. They can reorganize elements on a template based on calculations, voting, or other criteria.

How to Read this Report

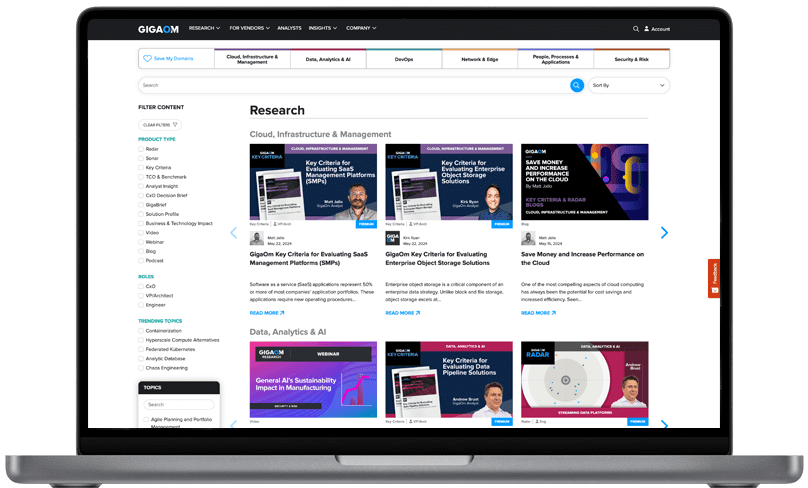

This GigaOm report is one of a series of documents that helps IT organizations assess competing solutions in the context of well-defined features and criteria. For a fuller understanding consider reviewing the following reports:

Key Criteria report: A detailed market sector analysis that assesses the impact that key product features and criteria have on top-line solution characteristics—such as scalability, performance, and TCO—that drive purchase decisions.

GigaOm Radar report: A forward-looking analysis that plots the relative value and progression of vendor solutions along multiple axes based on strategy and execution. The Radar report includes a breakdown of each vendor’s offering in the sector.

Vendor Profile: An in-depth vendor analysis that builds on the framework developed in the Key Criteria and Radar reports to assess a company’s engagement within a technology sector. This analysis includes forward-looking guidance around both strategy and product.