Table of Contents

- Summary

- The market

- Recession impact lingers for measurement

- Methods of measurement and the supply chain

- The audience shift: Fragmentation from online and mobile video

- Fragmentation requires integration, custom ad units

- Old habits die hard

- The new normal

- What can’t be measured can’t be sold

- Wanted: Standardized metrics

- The influence of social

- Conclusion and recommendations

- Appendix A: cross-media brand measurement supply chain (or ecosystem)

- About Lydia Loizides

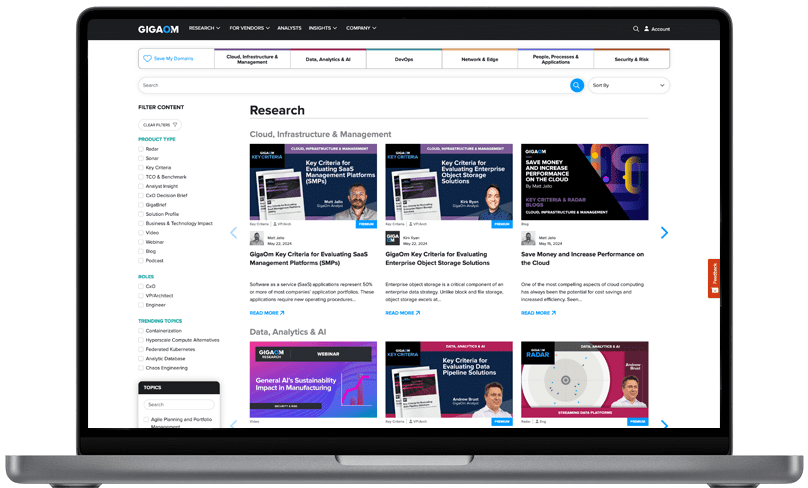

- About GigaOm

- Copyright

1. Summary

Long gone are the days when broadcast and cable networks, magazines, and radio were the gateways to customers. Today brand advertisers must go to much greater lengths to find their audiences. Savvier than those a decade ago, these marketers want integrated campaign measurement and key performance indicators (KPIs) from media companies across every channel at a level of granularity that previously was relegated to the direct marketing channel. Thus, brand advertising’s focus on cross-platform media measurement has grown dramatically in the past five years. This growth is a result of three macro-market events:

- The pressure of the recession on marketers and agencies to do more with less and on publishers to provide deeper levels of transparency and accountability in order to fairly value their advertising inventory

- The global adoption of online and social video networks including Facebook, Twitter, YouTube, and Hulu

- The rapid penetration of smartphone and tablet technology in the U.S. market, which has accelerated the fragmentation of consumers’ media consumption

Companies like Nielsen and Arbitron continue to invest in new measurement methods, shoring up existing infrastructure and exploring new ways to connect advertising performance across the most important media — TV, online, and mobile. These incumbents must marry their various audience panels in order to enable cross-platform reporting to ensure their own long-term revenue growth. They are the central providers of both measurement and the currency by which ad inventory is valued, but it can be argued that they have not kept up with client-side demand. Channel conflicts and competitive market pressures have forced adaptation but not necessarily innovation. As a result, up-and-comers including Bluefin Labs and Trendrr have been garnering the attention of CBS, NBC, ABC, and other major media channels by creating new success measures, including most tweeted, number of conversations, and friend-of-a-friend stories (FOAFS).

Within the next 36 months, the measurement of cross-platform digital video advertising will standardize, driven by the shift in media dollars from TV to online viewing, the adoption of the Making Measurement Make Sense (3MS) initiative, and another political and Olympic cycle. As marketers focus on measurable media dollars in the digital-advertising arena, market-level standardization will stall, as will the maturation of social TV and media cross-platform measurement.

This report takes a broad view across the ecosystem that is media measurement for brand advertising and explores how that ecosystem is struggling to solve the correlation between the two media-viewing behemoths, TV and online. It looks at the different challenges players face and offers an appendix detailing the important new players. Finally, it shines a light on the complexity of the impact that social media and mobile have on the media-measurement supply chain.